Blog Overview

I started blogging again in July 2023 after some shifting of my job responsibilities, and my children growing up which gave me a lot more discretionary time. I do this for me, but I hope some others find my posts interesting or useful in some way.Review - Vanguard Small-Cap Value Index Fund ETF (VBR)

4/24/2024 by Alan

This is one of my core positions I am dollar cost averaging into for a portfolio target of 10%. It is an Small-Cap Value Index Fund. This ETF is off its recent highs from March 28, 2024 and is down only 0.25% Year-To-Date. Its current 1-year return is up 13.52%.

Post Content, Images & Videos

This is one of my core positions I am dollar cost averaging into for a portfolio target of 10%. It is an Small-Cap Value Index Fund. This ETF is off its recent highs from March 28, 2024 and is down only 0.25% Year-To-Date. Its current 1-year return is up 13.52%.

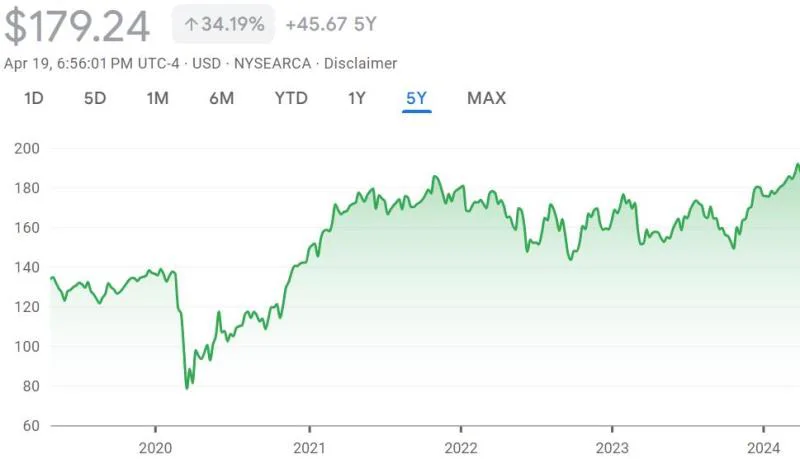

5-Year Chart

This fund has been doing well over the last 5 years, with a total growth of 34.19%.

S&P 500 vs VBR

The S&P 500 has been on a rampage the last 5 years compared to almost all Stock Market Indexes.- S&P 500: up 67%

- VBR: up 34%

Post Metadata

- Post Number: 233

- Year: 2024

- Slug: review-vanguard-small-cap-value-index-fund-etf-vbr

- Author: Alan

- Categories: Investing

- Subcategories: VBR

- Tags:

- Keywords: Vanguard, VBR

- Language Code: en

- Status: published

- Show On Homepage: 1

- Date Created: 4/24/2024

- Last Edited: 4/24/2024

- Date To Show: 4/24/2024

- Last Updated: 7/1/2025

- Views: 0

- Likes: 0

- Dislikes: 0

- Comments: 0